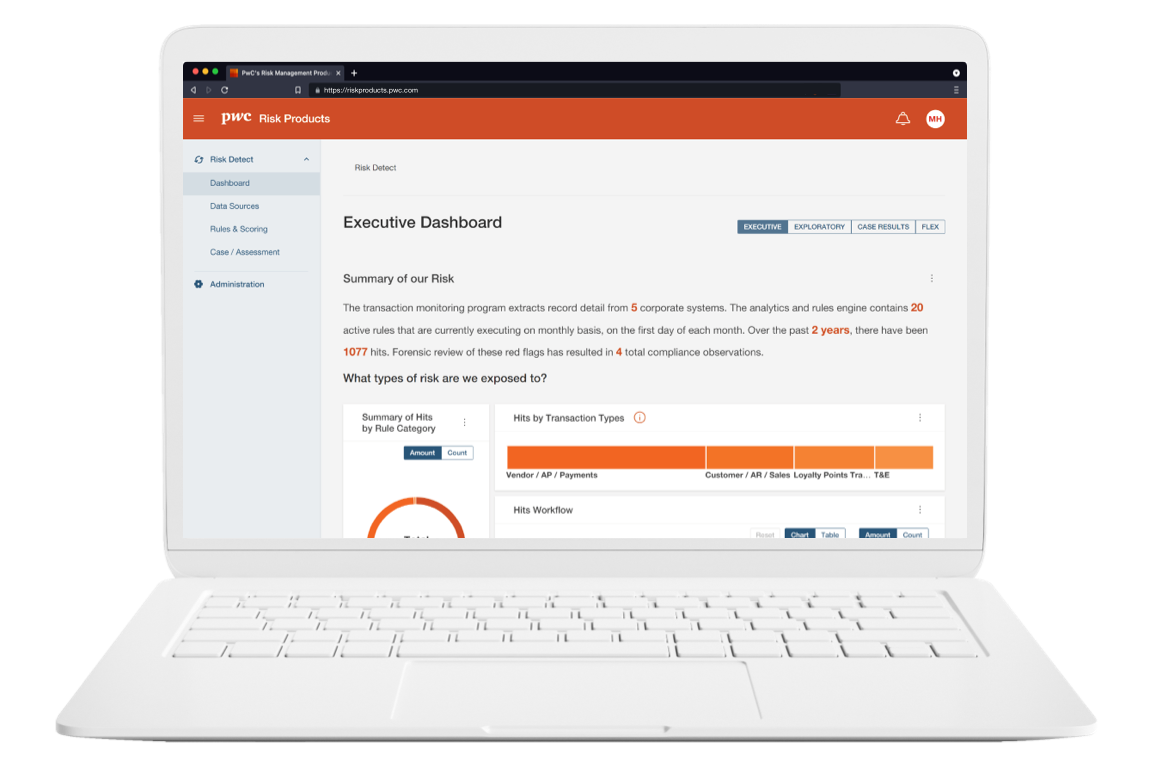

Risk Detect, a PwC Product

Address bribery, corruption and compliance risks with the power of advanced analytics

Identify and flag high risk activity with our digital risk detection and monitoring solution. Utilize advanced analytic algorithms and machine learning to get to key data points quickly and efficiently.

Avoid the financial and legal costs of corruption and non-compliance

Get a clear view of your risk to help safeguard your organization

Reviewing large volumes of data to target high risk activities is notoriously challenging. Risk Detect brings together disparate data sources to help you review transactions and documents faster, and applies advanced analytics so you can detect and respond to risk with more precision. Get a tech-enabled solution that does the heavy lifting for you — so you can build future-ready monitoring programs to address bribery, corruption, fraud and other compliance risks.

Get trusted experience and tested advanced analytics

Use advanced algorithms, coupled with PwC’s years of compliance and industry experience, to help detect risks faster and more accurately. Build machine learning and advanced analytics models with ease to help identify issues not visible to the human eye. Accelerate detection with risk indicators based on our knowledge of industry trends and regulatory expectations.

Utilize a tailored approach

Focus your analysis on risk areas that matter most to your organization. Access our library of key risk indicators and other proprietary content to develop business rules and processes optimized to your data. Get tailored analytics and perform statistical analysis to help understand what’s necessary to stay on top of risk.

Let us help you get set up

Our risk detection software is available off the shelf or as part of a managed service. Looking for help standing up a scalable, fit-for-purpose compliance monitoring program? Let us do the heavy lifting to get you up to speed.

Access actionable insights to implement proactive risk identification

Receive alerts that take you to the source of the problem and empower your team to investigate quickly. Use case management and workflow capabilities to create a central virtual team room and generate a defensible record of actions.

Automate operations to help reduce the cost of controls and increase coverage

Whether you’re reviewing high volumes of transactions or an entire portfolio of documents, automate the gathering and filtering of data to eliminate hundreds of hours of manual effort. With more extensive coverage, you can minimize false positives to focus your resources where it matters.

Integrate diverse data streams to gain a holistic view of your risk

Aggregate data from siloed sources including ERP systems, payment hubs, custom-built applications and third-party compliance technologies. Apply structured analysis and generate compelling visuals to share a high-level picture of risk with executive stakeholders.

Use cases for Risk Detect

For anti-bribery & anti-corruption (ABAC)

Proactive monitoring can reduce the frequency and impact of risky transactions. Action frameworks enable alerts that can be managed from identification through remediation. Monitor multiple threats to help uncover fraud in its many forms — including payroll fraud, vendor payment fraud, customer account fraud, credit card fraud, healthcare claims, and bribery and corruption risk.

For lending compliance

Say goodbye to stare and compare reviews. Automate compliance testing for HMDA, TRID, PPP, SCRA and other regulations. With Risk Detect, you can increase your sampling rate up to 100% and save up to 30 hours per week of manual effort per tester. (Individual client results will vary.)

For pharmaceutical & life sciences

Digitize your compliance program, strengthen risk planning and enable global risk monitoring. Risk Detect is informed by PwC’s decades of experience helping enhance risk management for pharmaceutical and life sciences companies. Access a library of key risk indicators (KRIs) to help detect potential issues and drive efficiency with proprietary monitoring checklists developed specifically for pharmaceutical risk.

For insurance

Automate the detection of potentially fraudulent insurance claims, parties, providers and organized criminal networks. Get alerts and workflow tools to help tackle suspected fraud earlier in the claims process. With proactive risk identification, you can help improve claim processing times and safeguard your organization from fraudulent costs.

Case Study

Microsoft raises the bar in corporate ethics by tackling corruption in real time

By leveraging data analytics to identify risky transactions for Foreign Corrupt Practices Act (FCPA) compliance oversight, Microsoft is able to navigate the complexity of their multi-sales channel and set a new standard for ethical business practices.

Learn moreRelated insights for Risk Detect

See what proactive risk management can do for your business

Talk to a professional today to learn more about our risk management and compliance technology.

Contact us